PNJ Recorded Strong Revenue Recovery

In 9 months, net revenue and NPAT on PNJ was at bn VND 25,574 (+ 104.4 % YoY) and bn VND 1,340 bn (+ 132.7 % YoY) respectively.

In the context of the retail market recovering, in 3Q2022, PNJ recorded net revenue of bn VND 7,364 (+739.7% YoY) and NPAT of bn VND 252 compared to bn VND -160 in the same period of 2021 (Q3/2021: PNJ closed 241/332 stores due to regulations on Covid-19 prevention).

In 9 months, net revenue and NPAT was at bn VND 25,574 (+ 104.4 % YoY) and bn VND 1,340 bn (+ 132.7 % YoY) respectively.

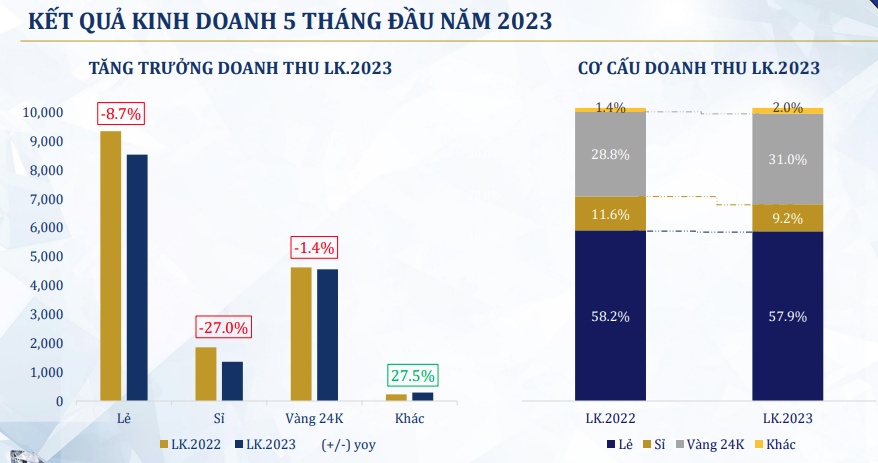

In terms of revenue growth by channel: YTD Retail sales increased by 113.3% YoY from growth in all brands and areas, making the most of the market, and customization and effectiveness of sale programs in 3Q2022 in accordance with the market context.

YTD Wholesale sales increased by 84.7 % YoY due to the low base of 2021 (wholesale business in the 3Q2021 was impacted by the 4 th wave of COVID), the recovery of the jewelry market in 2022, and the broad development of wholesale customers and products.

YTD 24K Gold sales increased by 104.2 % YoY due to changes in investment trends and customer needs amid high inflationary pressures and geopolitical instability.

Blended gross profit margin in 9 months was at 17.4% compared to 18.5% in 2021, mainly due to changes in the retail product mix. Total operating expenses in 9 months increased by 73.4 % YoY. The total operating expense/gross profit ratio decreased from 65.9% in 2021 to 59.4% in 2022.

The improvement in expense utilization is thanks to operation efficiency achieved through new technology in sales and management.

Regarding store network, in 9 months, PNJ opened 21 and upgraded 19 PNJ gold; opened 2 Style by PNJ; opened 2 PNJ Watch; closed 6 PNJ Gold and 6 PNJ Silver.

In 9 months, the PNJ store network consisted of 354 stores including 334 PNJ Gold, 8 PNJ Silver, 3 CAO Fine Jewelry, 4 Style by PNJ, and 2 PNJ Watch and 3 PNJ Art.

Tags:

Các tin khác

Standard Chartered Forecast Vietnam 2023 GDP Growth at 7.2%

“We still have conviction on Vietnam’s high growth potential over the medium term.” said Tim Leelahaphan, Economist for Thailand and Vietnam, Standard Chartered.

Tough year expected for banks in 2023

With a dim outlook for the banking industry, most securities firms forecast that banks will post conservative profit growth in 2023.

Vietnam’s Hiking Cycle Under Way, HSBC Says

In the latest report by HSBC, it is said that rising core inflation increasingly suggests the SBV’s hiking cycle is still under way.

Amazon Global Selling Vietnam Reveals its 2022 Vietnam SMEs Empowerment

Amazon Global Selling officially released the 2022 Vietnam Small and Medium Businesses (SMBs) Empowerment Report, which reflects a flourishing year of Vietnamese online export via cross-border e-commerce on Amazon.

Vietnam: Bracing for a Trade Winter

After growing over 17% y-o-y in the first three quarters of 2022, export growth of Vietnam sharply moderated in October, with November seeing the first meaningful y-o-y decline in two years.

Asia Economies to Benefit from China’s Opening in Second Half 2023

All considered, Asia economies proved surprisingly resilient in the Year of the Tiger. True, surging living costs squeezed the pockets of consumers and bottom lines of many businesses.

One More HDBank Leader Registered to Buy HDB Shares

Deputy General Director of Ho Chi Minh City Development Commercial Joint Stock Bank. Ho Chi Minh City (HDBank) registered to buy 120,000 shares of HDB.

Sign of a Loan Agreement for Ninh Thuan Province Onshore Wind Power Project

The project in Ninh Thuan Province will help Vietnam to reach its clean energy and climate action targets by offsetting about 215,000 tons of carbon dioxide annually.

ADB, BIM Wind Sign $107 Million Financing Package to Support Wind Energy in Viet Nam

The wind energy power plant will help Viet Nam reach its clean energy and climate action targets by offsetting about 215,000 tons of carbon dioxide annually.

International Agreement to Support Vietnam’s Ambitious Climate and Energy Goals

The Partnership will support Vietnam to deliver on its ambitious Net Zero 2050 goal, accelerate the peaking of its greenhouse gas emissions and transition away from fossil fuels to clean energy.

Vietnam to Receive $15.5 billion for Energy Transition

Vietnam has landed a $15.5 billion partnership with funders led by the European Union and the UK to help finance its transition away from coal.

FPT Announced Business Results in the 11 Months of 2022

Recently, FPT Software has expanded its presence in Southeast Asia with the opening of a new office in the center of Bangkok, Thailand.

ADB Lowers Growth Forecast for Developing Asia amid Global Gloom

The Asian Development Bank - ADB has lowered its economic growth forecasts for developing Asia and the Pacific amid a worsened global outlook.

Amazon Announces its Biggest Holiday Shopping Weekend Ever

Amazon announced that this year Thanksgiving holiday shopping weekend was its biggest ever, with customers around the world purchasing hundreds of millions of products across Thanksgiving, Black Friday and Cyber Monday.

Unilever Vietnam to Consolidate the Position in Circular Economy

Unilever Vietnam 's efforts on plastic waste management in particular, and sustainable development in general, are recognised at CSR Awards by Saigon Times Groups.

HSBC: The Vital Role of Voluntary Carbon Markets

The voluntary carbon market, when used by companies to complement – not substitute – the decarbonisation of their own operations as they transition to net zero, is one tool that could accelerate action to tackle climate change, HSBC remarks.

Archetype Group Celebrated 20 Years of Growth

Archetype Group was established in 2002 in Vietnam by a group of French entrepreneurs. Over the years, it has expanded its operations to 18 countries, employing more than 1000 collaborators.

ADB, HAYAT KIMYA to Support for Women and Children’s Lives in Vietnam

In Vietnam, ADB announced that it is estimated that only 43% of women have access to sanitary pads while only 52% of mothers use diapers for their infants.

HDBank is the Large-Cap Listed Company With the Best Annual Report 2022

The poll of large-cap listed companies in 2022 jointly held by Ho Chi Minh City Stock Exchange (HOSE), Hanoi Stock Exchange (HNX) and Investment Newspaper on December 02 has honored HDBank as the top bank in the category of the best annual report.

Sobanhang Excellently Won the Champion of National Innovative Technopreneur Contest

This is the final round of a 3-month contest journey of supporting innovative startups in Vietnam and Vietnamese individuals living and working outside Vietnam.

Tuyển chọn ứng viên chương trình thực tập sinh hộ lý Nhật Bản, lương cao

Trung tâm Lao động ngoài nước đã thông báo kế hoạch tuyển chọn 50 ứng viên tham gia chương trình thực tập sinh hộ lý Nhật Bản WAA năm 2025. Thời gian tiếp nhận hồ sơ hết tháng 6/2025.

TPBank đặt mục tiêu lợi nhuận 9.000 tỷ đồng, chia cổ tức 15% bằng tiền mặt và cổ phiếu

Ngày 24/4/2025, TPBank tổ chức Đại hội đồng cổ đông thường niên năm 2025. Tại đại hội, cổ đông thống nhất thông qua kế hoạch kinh doanh năm 2025 với nhiều chỉ tiêu tăng trưởng, đặc biệt là phương án chia cổ tức 10% bằng tiền mặt, 5% bằng cổ phiếu.

Cổ Loa: Từ vùng ven thành tâm điểm đầu tư mới phía Đông Hà Nội

Hưởng lợi trực tiếp từ các đại dự án hạ tầng đang được đồng bộ triển khai, khu vực Cổ Loa đang bước vào chu kỳ tăng trưởng mới, với tiềm năng tăng giá bất động sản ít nhất gấp đôi trong 5 năm tới, theo đánh giá của các chuyên gia.

SHB: Bứt phá vươn tầm trong kỷ nguyên mới, kế hoạch lợi nhuận tăng 25%, cổ đông tin tưởng đồng hành

Ngày 22/4, Ngân hàng Sài Gòn - Hà Nội (SHB) tổ chức thành công Đại hội đồng cổ đông (ĐHĐCĐ) thường niên 2025 với sự tham gia của hàng nghìn cổ đông và người được ủy quyền.

Duy trì cam kết với cổ đông, VPBank năm thứ 3 liên tiếp trả cổ tức tiền mặt

Năm thứ 3 liên tiếp, VPBank dự kiến duy trì chính sách cổ tức tiền mặt, thể hiện năng lực tài chính vững mạnh, chiến lược tăng trưởng hợp lý và cam kết mang lại lợi ích lớn nhất cho cổ đông.

Kao Siêu Lực: Từ tay trắng đến “vua bánh mì”

Hơn 40 năm trước, giữa những con phố tấp nập của khu Quận 6 và Quận 11 (TP.HCM), một gia đình người Hoa chạy nạn từ Campuchia đặt chân đến mảnh đất này với hai bàn tay trắng.

Nguyễn Đăng Quang: Từ tiến sĩ vật lý đến “doanh nhân mì gói”

Nguyễn Đăng Quang không chỉ xây dựng một “đế chế” Masan hùng mạnh mà còn góp phần thay đổi thói quen tiêu dùng của hàng triệu người Việt.

Trương Gia Bình: "Người Việt không biết cúi đầu"!

Trương Gia Bình không chỉ là một nhà lãnh đạo xuất sắc, mà còn là một biểu tượng của tinh thần tiên phong, không ngừng đổi mới và vượt qua nghịch cảnh.

Johnathan Hạnh Nguyễn: Tiên phong mở cửa “bầu trời” và thương mại xa xỉ

Từ một người tiên phong "mở cửa bầu trời" Việt Nam, Johnathan Hạnh Nguyễn đã trở thành người đặt nền móng cho thị trường hàng hiệu, phát triển hệ thống bán lẻ sân bay...

Mai Hữu Tín: Người kiến tạo những "cú bắt tay" tỷ đô

Được ví là "ông trùm” M&A “mát tay”, doanh nhân Mai Hữu Tín đã ghi dấu ấn sâu đậm trong giới kinh doanh Việt Nam.

Người dân mất tiền, mất lòng tin, doanh nghiệp “vạ lây” vì bẫy lừa đảo du lịch

Kỳ nghỉ lễ 30/4 - 1/5 đang đến gần, kéo theo nhu cầu du lịch, nghỉ dưỡng của người dân tăng vọt. Tuy nhiên, đây cũng là thời điểm “vàng” để các đối tượng lừa đảo trên mạng giăng bẫy với những chiêu thức ngày càng tinh vi, chuyên nghiệp.

“Vạch mặt” fanpage du lịch giả mạo dịp lễ 30/4 – 1/5

Trong thời đại số, nơi mọi thứ có thể được “tô vẽ” chỉ bằng vài cú click chuột, niềm tin trở thành thứ tài sản mong manh nhất.

TPBank đặt mục tiêu lợi nhuận 9.000 tỷ đồng, chia cổ tức 15% bằng tiền mặt và cổ phiếu

Ngày 24/4/2025, TPBank tổ chức Đại hội đồng cổ đông thường niên năm 2025. Tại đại hội, cổ đông thống nhất thông qua kế hoạch kinh doanh năm 2025 với nhiều chỉ tiêu tăng trưởng, đặc biệt là phương án chia cổ tức 10% bằng tiền mặt, 5% bằng cổ phiếu.

Cổ Loa: Từ vùng ven thành tâm điểm đầu tư mới phía Đông Hà Nội

Hưởng lợi trực tiếp từ các đại dự án hạ tầng đang được đồng bộ triển khai, khu vực Cổ Loa đang bước vào chu kỳ tăng trưởng mới, với tiềm năng tăng giá bất động sản ít nhất gấp đôi trong 5 năm tới, theo đánh giá của các chuyên gia.

“Cỗ máy” tạo lòng tin không cần sự thật

Các trang web, fanpage giả mạo trong ngành du lịch không còn là trò lừa đơn thuần, mà đã trở thành “mặt nạ” công nghệ được thiết kế tinh vi, táo bạo và đầy tính toán.

Ngành Điện thi đua lao động sáng tạo, tiên phong bước vào kỷ nguyên mới

Ngày 24/4/2025, Công đoàn Điện lực Việt Nam (EVN) đã tổ chức Lễ phát động Tháng Công nhân năm 2025 với chủ đề “Công nhân Việt Nam tiên phong bước vào kỷ nguyên mới”.

“Người chữa lành” cũng cần được chăm sóc

Công ty Cổ phần Công nghệ Y tế Nhật Việt không chỉ tiên phong đưa AI vào thực tiễn khám chữa bệnh, mà còn đưa nó đến gần hơn với chính những người lao động ngành y.

Công đoàn: “Mạch máu” dẫn truyền trách nhiệm trong “guồng quay” lợi nhuận

Nếu doanh nghiệp là “tế bào” của nền kinh tế, thì người lao động chính là “linh hồn” tạo nên sức sống cho “tế bào” đó.

Công đoàn – “nền tảng đạo lý” trong kiến tạo doanh nghiệp có trách nhiệm

Một công đoàn mạnh, hoạt động thực chất chính là “chứng chỉ” niềm tin, một tấm “hộ chiếu nhân văn” để doanh nghiệp bước vững chắc ra thế giới.

Quan hệ lao động hài hoà: “Nền móng” cho “đòn bẩy” kinh tế tư nhân

Kinh tế tư nhân đã và đang khẳng định vai trò trụ cột trong nền kinh tế Việt Nam hiện đại. Tuy nhiên, để “đòn bẩy” này thực sự phát huy hết tiềm năng, điều kiện tiên quyết không nằm ở vốn, công nghệ hay chính sách ưu đãi, mà ở chỗ sâu xa hơn: xây dựng một

Trứng gà cà gai leo Sadu: Điểm khác biệt làm nên "giá trị vàng"

Trứng gà cà gai leo Sadu là kết tinh của tâm huyết, sáng tạo và ứng dụng công nghệ cao vào nông nghiệp, mang đến sản phẩm an toàn, bổ dưỡng cho người tiêu dùng.

Người đưa bưởi Lam Điền lên bản đồ OCOP

Doanh nhân Nguyễn Tiến Luyện đã đạt được nhiều thành tựu đáng kể trong lĩnh vực nông nghiệp, đặc biệt là với sản phẩm bưởi OCOP tại xã Lam Điền, huyện Chương Mỹ, Hà Nội.

Hơn 2,3 triệu lượt hộ nghèo, đối tượng chính sách được vay vốn chính sách

Năm 2024, với tổng nguồn vốn tín dụng đạt gần 377.000 tỷ đồng, Ngân hàng Chính sách xã hội đã hỗ trợ hàng triệu hộ nghèo và đối tượng chính sách.

Bánh chưng Tranh Khúc: Hương vị Tết từ làng nghề OCOP

Được công nhận là sản phẩm OCOP, bánh chưng Tranh Khúc không chỉ lưu giữ hương vị truyền thống mà còn khẳng định vị thế thương hiệu của mình trên thị trường.

Đông trùng hạ thảo – "Thảo dược vàng" của huyện Thanh Trì

Huyện Thanh Trì (Hà Nội) không chỉ nổi tiếng với những làng nghề truyền thống mà còn khẳng định trên “bản đồ” nông nghiệp công nghệ cao với sản phẩm "thảo dược vàng".

Nhà ở xã hội giá 25 triệu đồng/m2 có hợp lý không?

Chương trình AI - tài chính và địa ốc cùng chuyên gia AI Lily Phạm với khách mời là ông Nguyễn Anh Quê - Chủ tịch Tập đoàn G6 về chủ đề: Nhà ở xã hội giá 25 triệu đồng/m2 có hợp lý không?

Dưới 3 tỷ đồng - Xu hướng đầu tư dòng tiền

AI và Tài chính - Địa ốc tuần này là cuộc trò chuyện giữa chuyên gia bất động sản AI Lily Phạm và ông Vũ Cương Quyết - TGĐ Đất Xanh Miền Bắc về chủ đề "Dưới 3 tỷ đồng - Xu hướng đầu tư dòng tiền"

Phú Quốc trước thềm APEC 2027: Liệu thị trường bất động sản có bứt phá?

Cuộc trò chuyện giữa chuyên gia AI bất động sản Lily Phạm với ông Nguyễn Anh Quê - Chủ tịch Tập đoàn G6 về chủ đề "Phú Quốc trước thềm APEC 2027: Liệu thị trường bất động sản có bứt phá?"

Xu hướng thị trường bất động sản 2025 và hiến kế giải pháp giải nhiệt thị trường

Cuộc trò chuyện giữa ông Nguyễn Quốc Khánh - Phó CT Hội Môi giới BĐS VN - Chủ tịch Công ty CP Đầu tư và phân phối DTJ và chuyên gia AI LiLy Phạm về “Xu hướng BĐS 2025 và hiến kế giải pháp giải nhiệt thị trường”.

Kỳ vọng và tiềm năng tăng giá của đất Đan Phượng

Cuộc trò chuyện giữa chuyên gia AI Lily Phạm với ông Nguyễn Văn Ngọc - Phó Tổng Giám đốc sàn bất động sản Newstarland về vấn đề kỳ vọng và tiềm năng tăng giá của đất Đan Phượng - Hà Nội.